Using expense tracking software to record, organize, and manage your personal and business expenses will save you a lot of time—and money—when tax day arrives.

But which expense tracking software should you use? What if you need to track mileage? Or keep scans of receipts?

We’ve collected the best expense tracking apps for scanning receipts, tracking expenses, and logging miles. Before we get to them, let’s talk a little bit about why you should be tracking your expenses in the first place.

Why You Should Use Expense Tracking Software

If you’re going to be tracking expenses for the IRS, it’s a good idea to use expense tracking software. (Unfortunately, your personal budgeting app probably won’t cut it.) It might seem like a hassle at first, but in the long run, it’ll save you a lot of time—and money.

You could just save paper receipts, but using an expense app is going to make the process easier. If you’re going to deduct expenses on your taxes, there’s a good chance you’ll be collecting many different types of receipts from all sorts of vendors.

Medical, moving, and education expenses are common. Small business owners might also track expenses from moving, business purchases, health insurance premiums, and more.

Using the right expense tracking software will help you store, categorize, and retrieve the receipts you accrue over the year.

And if you’ve ever been audited by the IRS with no receipts to show for it, you know how much that’s worth. Even if you haven’t, saving those receipts will save you money. It’s worth the little effort it takes.

Which Receipts Should You Save for the IRS?

There are many possible tax deductions for expenses, and figuring out if you’re eligible for them can be a hassle. It might be best to track your expenses for any of the possible deductions and figure out if you’re eligible later.

On the other hand, if you’re using a financial advisor or tax preparer, they can figure that out and use the receipts you’ve kept to save you the most money.

Here are a few of the most common deductions that you’ll need to keep receipts for:

- Medical and dental expenses

- Deductible business expenses

- Vehicle mileage for business purposes

- Business travel expenses

- Charitable contributions

- Teacher educational expenses

- Sale of your home

There are others as well. To see if there are any deductions you could be taking advantage of, check out the IRS’s Credits & Deductions for Individuals page. If you think any of these deductions might apply to you, it’s a good idea to start saving your receipts today.

If you’re a business owner, there’s a credit and deductions page for business that you’ll find useful.

How Long Should You Keep Receipts for Tax Purposes?

In addition to digital copies of receipts, you should keep physical receipts for three years.

So why, if you’re keeping physical copies, should you use expense tracking software? Because it makes your life a whole lot easier. You won’t need the physical copies unless you get audited, and your expense tracking app will speed up the tax-filing process.

The Best Apps for Tracking Mileage and Expenses

The best expense tracking software for your particular situation depends on whether you’re tracking as an individual or as a business owner. Self-employed people and business owners generally need to track more expenses and may need more organizational features from their app.

Individuals, on the other hand, probably won’t keep too many receipts. There are, of course, exceptions. If you think you’ll need a lot of receipt-scanning power, be sure to check out the business section below.

First, however, we’ll start with apps to track mileage and expenses for individuals.

For Individuals With Few Expenses: Expensify Free

Expensify is one of the best apps for tracking mileage and receipts, no matter whether you’re an individual with few expenses or a globe-hopping executive. Their free version is great for individuals who need 10 receipt scans or fewer each month.

SmartScan pulls out the relevant information from each receipt and stores it on Expensify’s servers, where you have unlimited storage space. When tax season rolls around, you have everything you need at your fingertips.

If you start needing more than 10 scans per month, you cam upgrade to the Team plan, which we’ll discuss below.

Download: Expensify for iOS | Android (Free)

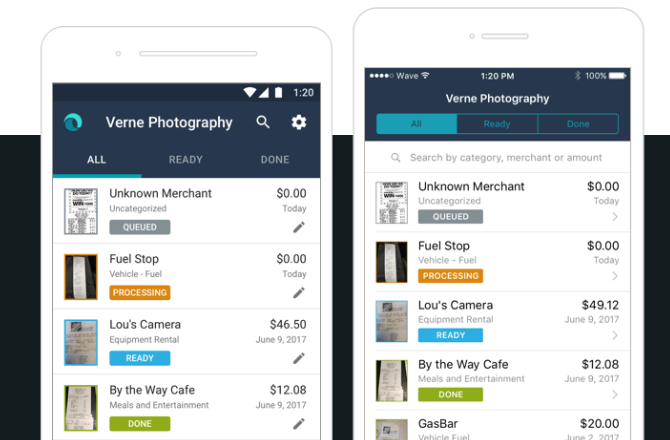

For Individuals With Paper and Electronic Receipts: Receipts by Wave

Receipts by Wave, like Expensify, pulls the relevant information out of your receipt scans, which is great for expense tracking. But it also lets you forward email receipts to an email address where it will input that information into your account as well.

Few people have only paper receipts, so this functionality can save you a lot of time.

And Wave is totally free unless you want to process credit card payments or payroll (which, if you’re not self-employed or a business owner, you probably won’t). It’s tough to beat that.

Download: Receipts by Wave for iOS | Android (Free)

For People Logging Lots of Miles: MileIQ

Mileage tracking can be a pain. Independent contractors, salespeople, executives, and other professionals might drive thousands of miles in a year and need to record all of those trips. MileIQ is one of the best apps for mileage tracking because it’s almost completely automated.

The app knows when you’re driving, and runs in the background to track your mileage. When your drive is done, you swipe right for business travel or left for personal travel. You can also use its customization features to make logging and categorization even easier.

With 40 free drive logs per month, many people can use the app without paying. You can also pay $60 per year to get the Premium version, which gives you unlimited mileage tracking. (Interestingly, if your company has an Office 365 Business or Business Premium subscription, you can get MileIQ for free.)

Download: MileIQ for iOS | Android (Free)

For Business Owners: QuickBooks

Because it’s a full-featured accounting app for business, QuickBooks has robust expense tracking features (it’s also the best accounting software for freelancers). Expenses are easily categorized so you don’t have to sort through them at tax time to figure out where they should be deducted.

QuickBooks learns how to auto-categorize transactions over time, saving you the time and effort of entering them manually. You can even customize your expense categories if your accountant needs additional information.

The mobile apps let you attach receipt images to transactions on the go, and the Self-Employed plan also lets you track mileage. There’s no free version of QuickBooks, but you can get started with for $5 per month on the Self-Employed plan or $7 per month with Simple Start.

The biggest advantage to using QuickBooks as your expense tracking software is that it gives you everything else you need to run the accounting for your business.

Download: QuickBooks for iOS | Android

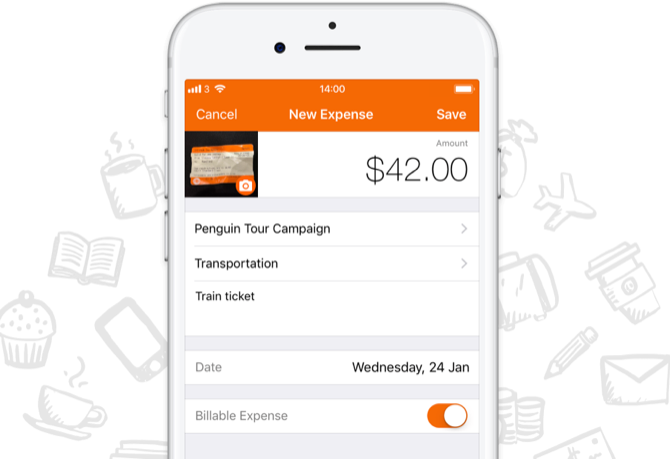

For Freelancers: Harvest

Harvest is best known as a time-tracking tool, but it also packs some great features for expense tracking. You can take a quick photo of a receipt to log the expense, and you can even mark it as billable to include it on a client’s next invoice.

Because it integrates with QuickBooks, you can import your expenses and have them ready to deduct when tax season comes.

You can use Harvest for free for up to two projects. If you want to include more projects, you’re looking at $12 per month, which is more than many of the other options available. That being said, it does give you great time-tracking features, and even lets you send invoices and estimates.

Download: Harvest for iOS | Android (Free)

Start Tracking Receipts and Expenses for Taxes

It might seem like a hassle, but using an app to track mileage, receipts, and other expenses will save you money in the long run. And with a bevy of great expense tracking app options, there’s no reason not to get started right away.

The earlier you start, the easier time you’ll have when tax day arrives next year.

from MakeUseOf https://ift.tt/2Hx4sRl

via IFTTT

No comments:

Post a Comment